US tariffs to hit exports of made in India iPhones, auto parts

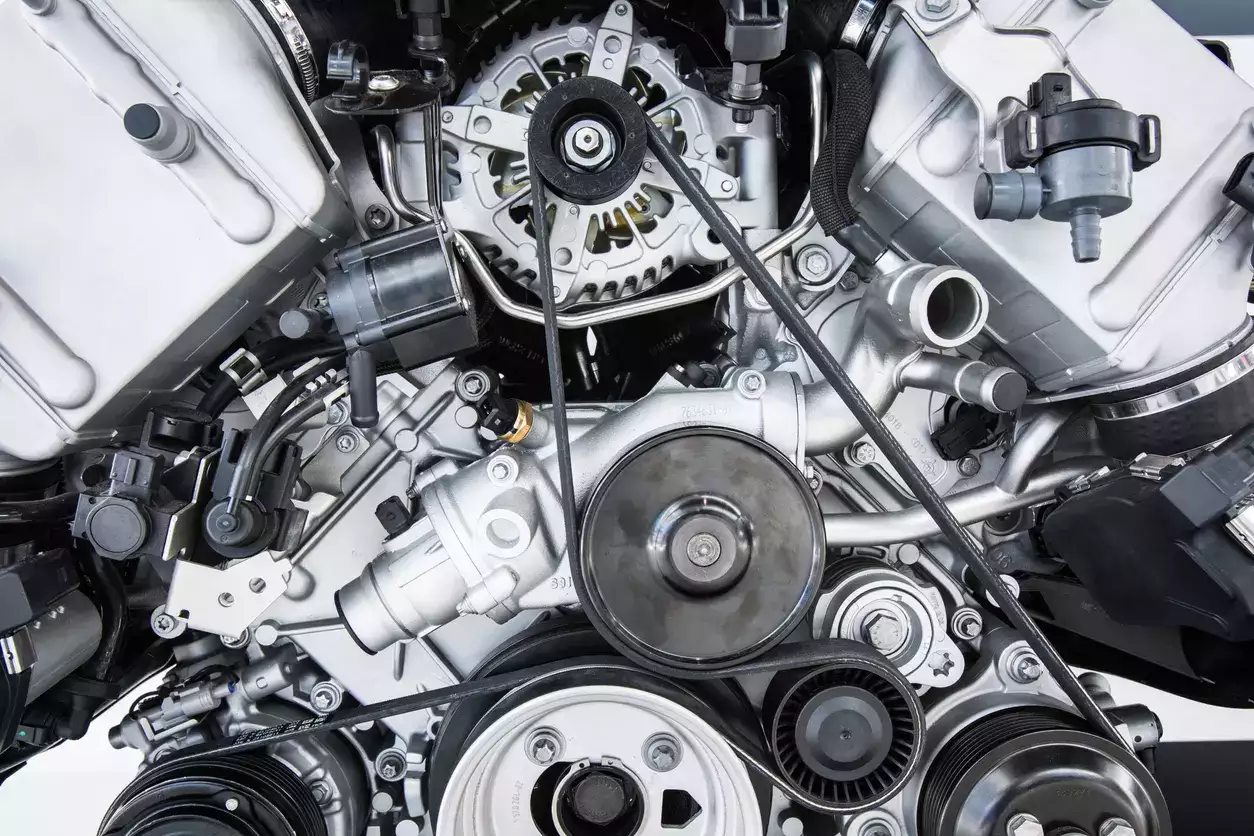

The situation is equally grave for auto component makers, who ship parts worth billions of dollars to the US - estimated at around USD 7 billion for this fiscal against USD 1.4 billion worth of American imports - and thus run the risk of losing business in case the US increases tariffs on products coming out of India, an assessment carried out by TOI shows.

Apple currently is one of the biggest exporters of electronic goods from India as it ships iPhones to global markets, with the majority of them flowing into China. Estimates put the shipments to the US at close to USD 8-9 billion this financial year itself with the company increasingly using its India factories to produce massively for the American market. The India products reach the US with zero duty, making it a profitable deal for the company.

However, what is bothering the new US administration under Trump is the 16.5% duty that New Delhi charges on phones and other electronics products when they are imported to India. "The fear of the industry is that if Trump really goes ahead and slaps a reciprocal duty of 16.5% on smartphones and electronics products being shipped out of India, it will immediately reverse the maths against our manufacturing strength," a key vendor in the ecosystem said.

While a recent decision of the Trump administration to slap a 10% duty on Chinese electronics imports is good news for Indian manufacturing, the situation will completely change if India is brought under a 16.5% import duty regime in America.

"That would mean our manufacturing will become more expensive than China due to the higher duty. So, Apple will really have no benefit of making in India, and would rather find it beneficial to ship its products out of China at 10% duty," another vendor said.

And it's not just Apple - Samsung is also shipping its India-made devices to the US, and so is Motorola. "The whole business case for export of smartphones will get disrupted," the vendor said.

On the front of auto components, the situation is equally tense. "While we send our parts to the US at a duty of around 1-2% - it'ss zero for many items - India imposes duty across multiple slabs for the components coming from the US. The actual duty ranges between 7.5% and 15%," a component maker said.

The only saving grace that Indian makers see is the fact that the share of Indian components in the US is minuscule compared to what it buys globally. "We are just about USD 7 billion to the overall USD 300-billion worth of component imports that the US carries out," the auto vendor said.