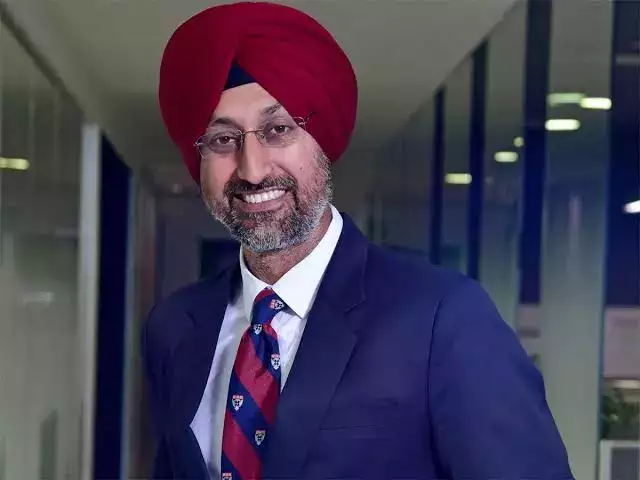

Auto Expo 2025 | Kia India's Hardeep S Brar says 2 EVs coming; expects 0-5% growth in FY26

What is your take on Kia's success in the Indian market in a short time?

We feel very proud of our success in the Indian market but yet we know that to stay on top of the game, we have to do things consistenly well. Cant sit on our laurels. We have about 6% market share right now.

Is 6% a good share to have, is it according to plan?

It is better than the plan. There are only six companies in India which are over 6%, the other five OEMs have been in the market for over 25 years. There are players in this market for over 25 years but have not been able to reach a market share of 6% so this (what we. have achieved) is by far the best for the new entrant.

As per SIAM data, in the April-December period of 2024, sales (factory dispatches) were flat. Is that something you're worried about, is it because of the segments you are in and does it mirror the market trend?

We follow the calendar year but even for the April-December period, we were flat and in line with the market because unlike some other OEMs, we did not have any new launches. So to keep pace with the market in the absence of any new product is creditable. Anyway, industry has grown by about 4% in retail sales while we have grown by 6%.

What is your growth forecast for FY26 and calendar 2025?

There are a lot of headwinds and good tailwinds so it is very difficult to put a number to it but we feel anywhere between 0-5% is the growth expectation.

That's a very wide range.

Yes, it is and I will tell you why. Among the positives is that government investments, which had dried up last year due to the elections, have picked up in the December quarter. The negatives are the global pressures, how will the incoming US President Donald Trump look at India? India's IT sector was badly impacted last year, which is showing a positive trend now...disposable incomes are not slowing down in India, but the GDP is. And we understand the slowing GDP is largely due to government investments being stopped earlier and even private investments were slow as corporate profits were hit...enquiries have come down in line with the slowdown. As I said, there are both headwinds and tailwinds...we will have some certainty by the end of the quarter.

Which new products are being showcased at the Bharat Mobility Global Expo 2025?

Syros, which has been launched last month and for which deliveries will start this month. Then, there is new EV6 and new EV9 (which will be launched from March onwards). In EV6, we have added 16 more enhancements over older EV6 so that the range increases from 528 km in single charge to 630 km. For EV9 too the range now is 600 plus km in single charge.

You've spoken about a mass market, Made-in-India electric car on the horizon...

We are coming with not one but two mass market EVs (Electric Vehicles). One will be launched in the second half of this calendar year and the second one will be launched by the beginning of next year. The EV6 and EV9 are CBU (completely built unit) imports but what we are now saying is we will launch two EVs which have been completely built in India. The first EV is also a UV.

What kind of cost competitiveness will you get by manufacturing in India?

I cannot give you the percentage of localisation of the new model, but I can tell you that right now, currently, our localisation for the entire product portfolio is close to 80%.

And the gap still, despite increasing industry localisation, in the price of an EV versus an ICE vehicle in India?

Looking at equivalent products of other players, the price difference is anywhere between 30-50%. That is also one of the reasons people shift over to ICE variants - upfront cost differential, charging issues etc. Let's see when we announce the price of our Made-in-India EVs. It is difficult to say right now whether our product will narrow the cost differentail with ICE variants because we have not yet started work on pricing.

Hyundai and Kia are part of the same group. What are the synergies and differences in both the companies' approach to the Indian market?

We are competitors in the market...Our customer profile is such that we connect a lot with Gen Z because Kia is a newer brand, a little quirky and attractive. Hyundai, on the other hand, has been in India for a very long time and their customers are older, seek more trust...distribution and marketing strategy is built on the kind of customer we want to target. Our showrooms are more plush (compared to Hyundai's), our product features also differ. For example, we give air purifiers in our high end variants. Hyundai does not.

The industry is now focusing on sustainability and electrification but there is a dichotomy about BEVs (Battery Electric Vehicles) versus Hybrids. Your view?

For the last five years, the Indian government has been pushing for EVs and OEMs have invested in EVs. Now, if you suddenly change track, what happens to all these investments? There should be consistency in policy. There should not be any incentives on Hybrids, if someone wants to sell on the merit of Hybrid tech, let them, do that...Any technology should be supported through long term thought process. Globally, we have Hybrid products but they need to be tweaked if we were to get them into India. We are looking at the trends, if the trend is catching up then we would like to bring these products in.